Maine’s top banking regulator told lawmakers on Wednesday that his agency has not detected any “material changes” at state-chartered financial institutions following recent bank failures elsewhere across the country.

Federal officials have taken emergency measures to shore up consumer confidence in the banking system following the failure of Silicon Valley Bank in California and Signature Bank in New York. But financial markets remain jittery and a new poll from The Associated Press-NORC Center for Public Affairs Research suggests that a majority of American do not believe federal regulators are doing enough to oversee banks and other financial institutions.

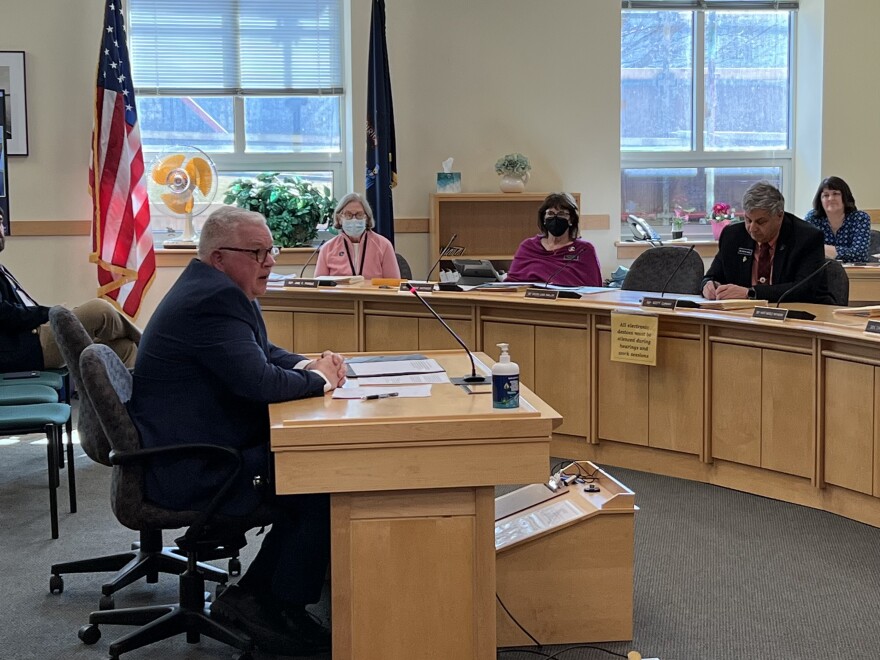

Lloyd LaFountain, superintendent of the Maine Bureau of Financial Institutions, said his agency regularly monitors the health of state-chartered banks and credit unions. LaFountain said he or other bureau staff have had direct contact with management at all of the state-chartered banks to talk about issues, including outreach to customers as well as any “unusual inflows or outflows of deposits.”

LaFountain said state-chartered banks and credit unions “continue to operate in a safe and sound manner” and local institutions tend to be conservative in their approach. State law also requires all financial institutions to be insured by the Federal Deposit Insurance Corporation, or FDIC, or the National Credit Union Administration. Individuals’ deposits are insured up to $250,000.

"Through the bureau's continuous monitoring and analysis of Maine-state chartered institutions, we report no material changes to the financial condition of our state-chartered financial institutions or the safety of deposits of Maine consumers as a result of the bank failures that have occurred in New York and California,” LaFountain said.

LaFountain also told members of the Legislature’s Health Coverage, Insurance and Financial Services Committee that state-chartered banks and credit unions are less dependent on specific economic sectors than Silicon Valley Bank. Experts have attributed that banks’ failure to a combination of an over-reliance on deposits from Silicon Valley technology companies, rising interest rates and an old fashioned “run” on the bank by customers as news quickly spread about the institution’s financial troubles.

"We don't really have any banks here in Maine that I can truly point to as having the concentration of deposits like Silicon Valley had,” LaFountain said. “Silicon Valley was primarily, it was really tech. Here in Maine, they are well diversified. There isn’t one bank that you can point to to say, ‘Oh, that’s where you go to deposit your agricultural revenue or this is where you go to deposit your fishing revenue.’ For our banks, it’s very diverse deposits.”

Several committee members raised concerns that some customers – particularly those with deposits exceeding $250,000 – may be tempted to move their money from state-chartered banks to the small number of large, national banks that federal regulators have indicated are “too big to fail.” Such a move away from regional banks could have implications beyond the current immediate crisis because they often provide mortgages, commercial and personal loans to customers.

“Is there anything we can do as a committee, as a state or as a bureau to help our local banks and credit unions?” asked Sen. Donna Bailey, D-Saco, the committee co-chair.

LaFountain said Wednesday’s invitation to speak with the committee was one way to do that.

“It allows me to give you the opportunity to tell you that Maine banks and credit unions are safe and sound,” he said.